REPOSSESSIONS ARE RISING

SELLERS NEED SOLUTIONS

Secure My New Playbook & Be The One They Turn To

Find Out More HereFeatured in:

What You'll Learn:

Are you ready to make the most of 2025’s repossession wave without wasting money and risking lawsuits, bad press, or dodgy deals?

Thousands of UK homeowners and landlords are sliding into arrears right now. That means opportunities for savvy investors… if you know how to act safely, ethically, and profitably.

That’s why I created The Repossession Playbook, a step-by-step system to help you:

- Identify distressed property opportunities early

- Talk to sellers in crisis without killing the deal

- Protect yourself with fast, reliable due diligence

- Close profitable deals while safeguarding your reputation

- Do good whilst doing good business

Contents:

- Module 1: The 2025 Repossession Landscape: the 5 stages of repossession & lender rules you must know

- Module 2: Talking to Distressed Sellers: exactly what to say (and what NOT to say)

- Module 3: Safeguarding & Due Diligence for Investors: how to protect yourself legally, ethically, and financially

- Module 4: Resource Toolkit

All designed to complete in under a weekend so you can hit the ground running.

PLUS YOU BENEFIT FROM MY 100% FAIR PLAY GUARANTEE

EARLY BIRD BONUSES:

If you enrol now you also get...

- One-page Cheatsheet + Investor Due Diligence Checklist

- Seller Conversion Script - take the guesswork out of what to say to close deals

- UK Data Sources & Ethical Practice

- Distressed Assets Deal Flow Process

- Lead Generation Quick Start

PLUS

- Join now and you'll get a members-only live deal closing workshop with me (worth £97)

Why Now?

- Interest rates and economic pressure mean arrears are climbing.

- Court backlogs are clearing, leading to repossessions increasing.

- Lenders are taking action to secure their liabilities.

- Investors can use multiple exits to step in when money is tight.

- Investors who move now will secure the best deals before competition ramps up.

Launch Offer:

Just £57 (normally £97)

Remember: this early bird price is limited until I put the price up.

I’m not promising you millions, just confidence, clarity and sane profit in a mad world

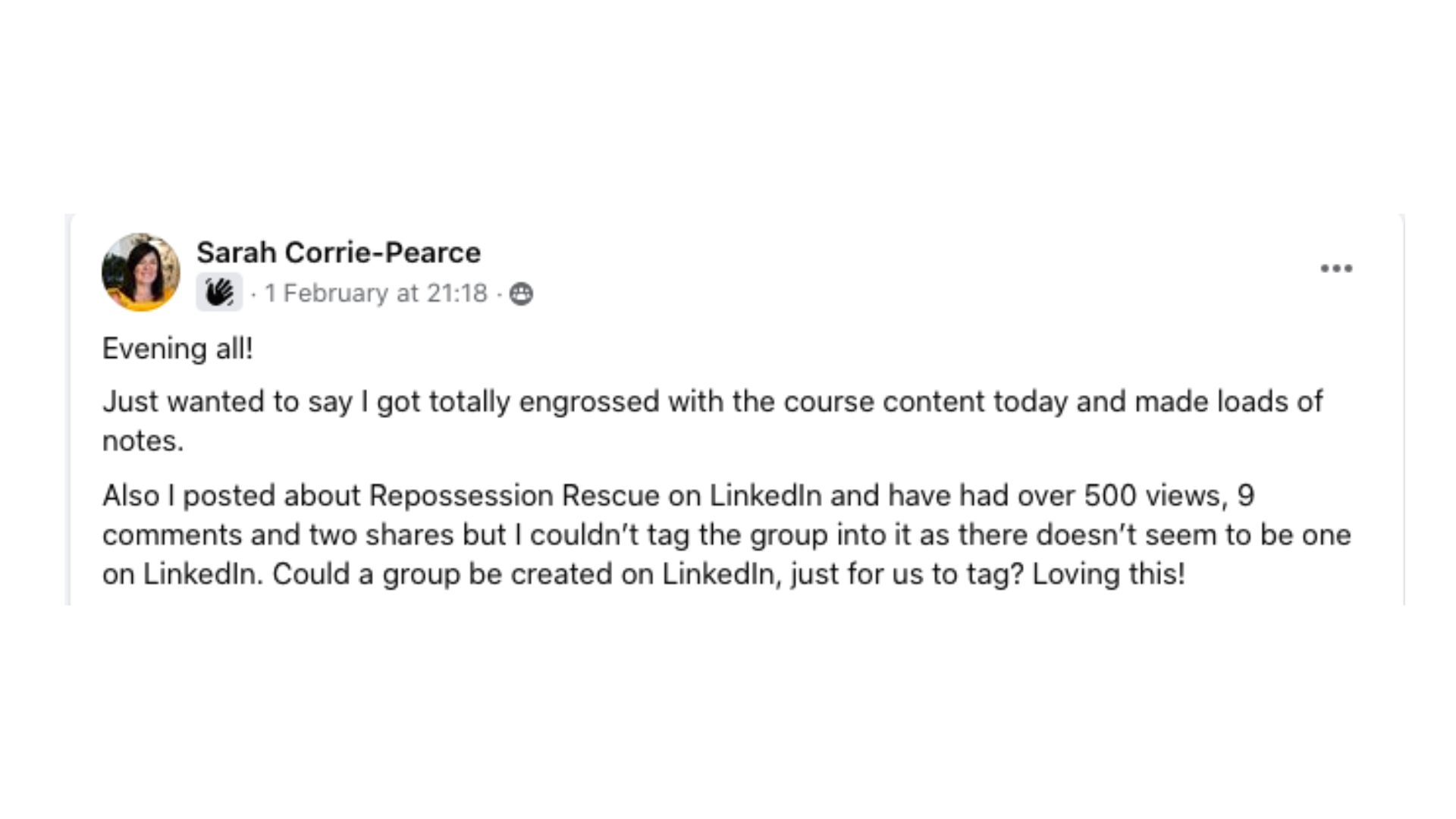

Grab Your Place HereJust a few comments from people I've trained...

Grab Your Playbook Now - £57

Give Me The Playbook Now

Who Is This For?

I'm Trish a former mental health nurse who became involved in property in 2003. I've been dealing with repossessions and distressed assets since then, and have seen the rise and fall of markets several times. I know homeowners and property investors who find themselves in financial distress usually need more help than banks can offer.

I'm a regular commentator and media voice on repossessions, money and mental health and I believe passionately that property investors can support people in crisis.

So this is for:

- Property investors who want below-market-value (BMV) deals without court battles or bad press.

- New investors who want a fast, practical shortcut to understanding repossession strategies.

- Experienced investors who use options, rent-to-rent and other strategies and need an insight on lenders, courts, and vulnerable sellers.

Why Should You Trust Me To Teach You?

When you understand how to approach a distressed situation with clarity, empathy, and solid business sense, everyone wins.

You protect your investment. You protect your profit. You protect your reputation. And sometimes, you even save someone’s home (and life).

That’s what The Repossession Playbook is all about; practical, proven strategies to help you act decisively and profitably without ever crossing the line into sleazy tactics.

I’ve had personal and professional experience with property, business, debt, and repossession.

I’ve been on the front line, helping homeowners, landlords, and investors navigate the chaos that happens when finances collapse and businesses and homes are at risk.

I’ve sat across the table from families who were terrified of losing everything, and I’ve helped countless investors step in the right way; fast, fair, and with compassion.

In that time, I’ve seen the best and worst of our industry.

That’s why I built my reputation on what I call the “People & Profit” approach: doing good business ethically. Because people in distress might be vulnerable but they aren’t stupid. They can smell exploitation a mile off.

And if you’re wondering whether I know what I’m talking about… just scroll down.

You’ll see examples of just a few places where I’ve been quoted, featured, and interviewed across the UK property press, lenders and mainstream media. This isn’t theory for me. It’s two decades of real experience, tested in the field, with real people and real results.

Bottom Line:

If you’re serious about building your assets in the chaos of the current economy AND you want to do it profitably, confidently and ethically, you’re in the right place.

Get The Playbook

Early access price ends soon and the price goes up to £97

Click Here For Clarity & Confidence